Phishing is a form of cybercrime that involves the use of deceptive emails, websites, or messages to trick individuals into providing sensitive information such as usernames, passwords, and credit card details. In the context of online banking, phishing typically involves sending emails that appear to be from a legitimate financial institution, prompting recipients to click on a link and enter their login credentials.

Once the phishing scammer obtains this information, they can access the victim’s online banking account and carry out fraudulent transactions. This can result in financial loss and compromise the security of the victim’s personal information.

To protect oneself from falling victim to phishing attacks in online banking, it is important to be cautious of unsolicited emails or messages that request sensitive information. Always verify the authenticity of the sender before clicking on any links or providing personal information. Additionally, ensure that you are using secure and reputable online banking platforms that have robust security measures in place to protect against phishing attacks.

Overall, phishing poses a significant threat to online banking security, and individuals must remain vigilant and take proactive steps to safeguard their personal and financial information from cybercriminals.

Phishing is a malicious act where a scammer pretends to be a trustworthy entity to deceive individuals into providing confidential information. This can include financial details like credit card numbers or login credentials for online accounts. It is important for individuals to be vigilant and cautious when sharing personal information online to protect themselves from falling victim to phishing attacks.

Phishing attacks are a common tactic used by cybercriminals to steal sensitive information such as usernames, passwords, and credit card details. Understanding how phishing works and being able to identify phishing attack indicators is crucial in protecting oneself from falling victim to these scams.

Phishing attacks typically involve sending deceptive emails or messages that appear to be from a legitimate source, such as a bank or a trusted organization. These emails often contain links that, when clicked on, lead to fake websites designed to steal personal information. Phishing attacks can also involve phone calls or text messages that attempt to trick individuals into providing their sensitive information.

There are several indicators that can help identify a phishing attack. These include grammatical errors or spelling mistakes in the email or message, requests for personal information such as passwords or credit card numbers, and urgent or threatening language designed to prompt a quick response. Additionally, phishing emails often contain links that, when hovered over, reveal a different destination than what is displayed in the text.

To protect oneself from phishing attacks, it is important to be cautious when receiving unsolicited emails or messages, especially those requesting sensitive information. It is also recommended to verify the legitimacy of the sender by contacting them directly through a trusted source, rather than clicking on any links provided in the suspicious email.

In conclusion, understanding how phishing works and being able to identify phishing attack indicators is essential in safeguarding oneself from falling victim to these scams. By remaining vigilant and taking the necessary precautions, individuals can protect their personal information and avoid becoming victims of phishing attacks.

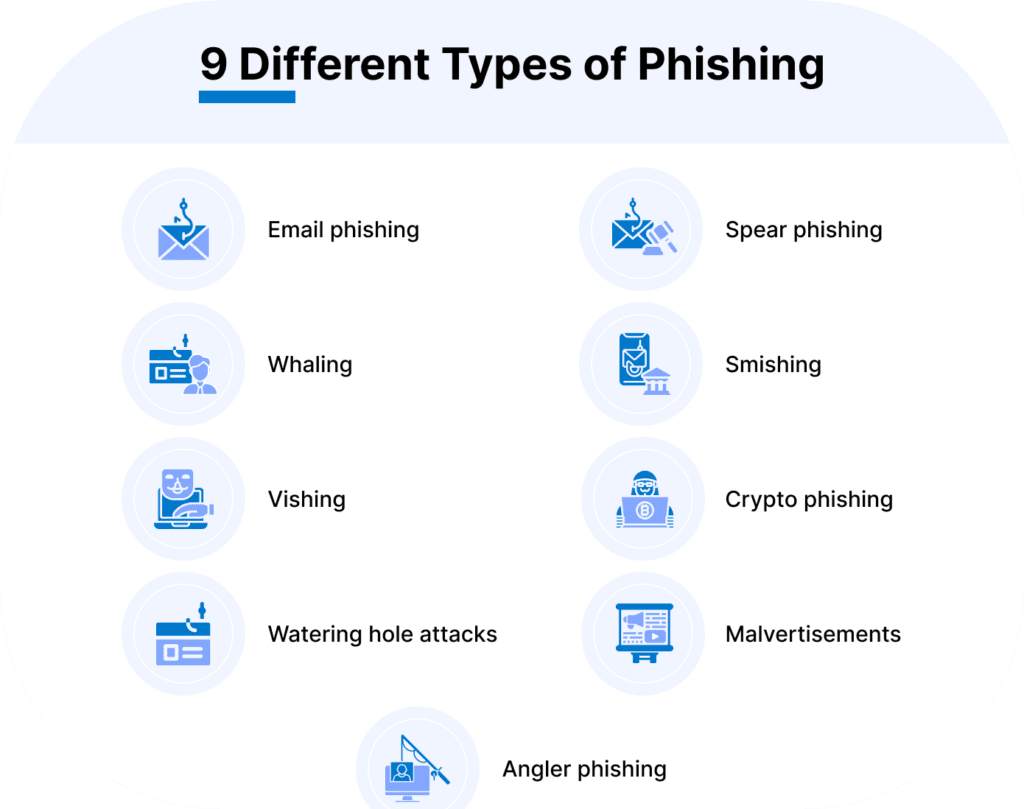

Phishing attacks are a common form of cybercrime that aims to steal sensitive information such as login credentials, credit card numbers, and personal data. There are several types of phishing attacks that cybercriminals use to deceive individuals and organizations.

One common type of phishing attack is email phishing, where attackers send fraudulent emails that appear to be from legitimate sources such as banks or government agencies. These emails typically contain a link that, when clicked, directs the victim to a fake website where they are prompted to enter their personal information.

Another type of phishing attack is spear phishing, which is a more targeted form of phishing that involves personalized emails sent to specific individuals or organizations. These emails are often crafted to appear as if they are from someone the victim knows or trusts, making it more likely that they will fall for the scam.

Phishing attacks can also take the form of smishing, where attackers send text messages containing links to fake websites or requesting personal information. Similarly, vishing involves phone calls from scammers pretending to be from legitimate organizations and asking for sensitive information.

It is important for individuals and organizations to be aware of the different types of phishing attacks and to take steps to protect themselves from falling victim. This includes being cautious when clicking on links or providing personal information online, as well as using security measures such as two-factor authentication and anti-phishing software.

Phishing in the context of online banking refers to the fraudulent practice of attempting to obtain sensitive information such as usernames, passwords, and credit card details by disguising as a trustworthy entity in an electronic communication.

Phishing poses a significant threat to online banking security as it can lead to unauthorized access to accounts, financial loss, and identity theft. By tricking individuals into disclosing their confidential information, cybercriminals can exploit this data for malicious purposes.

Understanding the impact of phishing on online banking Yes, everyone who uses online banking is at risk of falling victim to phishing attacks. These attacks are becoming increasingly sophisticated, making it challenging for individuals to distinguish between legitimate and fraudulent communications.

To protect yourself from phishing attacks in online banking, it is essential to be cautious and vigilant. Some preventive measures include never clicking on suspicious links, verifying the authenticity of emails and websites, using strong and unique passwords, and regularly monitoring your accounts for any unusual activity.

To identify and avoid phishing attempts while using online banking, always double-check the sender’s email address, look for spelling and grammatical errors in the communication, avoid providing personal information over email or text, and report any suspicious activity to your bank immediately. Additionally, consider using security tools such as firewalls and antivirus software to enhance your online banking security.

11 Types of Phishing Attacks

Since being first described in 1987, phishing has evolved into many highly-specialized tactics. And as digital technologies progress, this attack continues to find new ways to exploit vulnerabilities.

Below are 11 of the most pervasive types of phishing:

Standard Email Phishing – Arguably the most widely known form of phishing, this attack is an attempt to steal sensitive information via an email that appears to be from a legitimate organization. It is not a targeted attack and can be conducted en masse.

Malware Phishing – Utilizing the same techniques as email phishing, this attack encourages targets to click a link or download an attachment so malware can be installed on the device. It is currently the most pervasive form of phishing attack.

Spear Phishing – Where most phishing attacks cast a wide net, spear phishing is a highly-targeted, well-researched attack generally focused at business executives, public personas and other lucrative targets.

Smishing – SMS-enabled phishing delivers malicious short links to smartphone users, often disguised as account notices, prize notifications and political messages.

Search Engine Phishing – In this type of attack, cyber criminals set up fraudulent websites designed to collect personal information and direct payments. These sites can show up in organic search results or as paid advertisements for popular search terms.

Vishing – Vishing, or voice phishing, involves a malicious caller purporting to be from tech support, a government agency or other organization and trying to extract personal information, such as banking or credit card information.

Pharming – Also known as DNS poisoning, pharming is a technically sophisticated form of phishing involving the internet’s domain name system (DNS). Pharming reroutes legitimate web traffic to a spoofed page without the user’s knowledge, often to steal valuable information.

Clone Phishing – In this type of attack, a shady actor compromises a person’s email account, makes changes to an existing email by swapping a legitimate link, attachment or other element with a malicious one, and sends it to the person’s contacts to spread the infection.

Man-in-the-Middle Attack – A man-in-the-middle attack involves an eavesdropper monitoring correspondence between two unsuspecting parties. These attacks are often carried out by creating phony public WiFi networks at coffee shops, shopping malls and other public locations. Once joined, the man in the middle can phish for info or push malware onto devices.

BEC (Business Email Compromise) – Business email compromise involves a phony email appearing to be from someone in or associated with the target’s company requesting urgent action, whether wiring money or purchasing gift cards. This tactic is estimated to have caused nearly half of all cybercrime-related business losses in 2019.

Malvertising – This type of phishing utilizes digital ad software to publish otherwise normal looking ads with malicious code implanted within.

- Top 5 Ways to Spot a Phishing Email in Online Banking

- 10 Common Techniques Phishers Use to Target Online Banking Customers

- The Ultimate Checklist for Protecting Your Finances from Online Banking Phishing Scams

- 7 Warning Signs of a Phishing Attack in the World of Online Banking

- 15 Essential Tips for Safeguarding Your Online Banking Account from Phishing Attempts